updated 9:53 AM EDT, Wed July 25, 2012

STORY HIGHLIGHTS

- People are asking what triggered the Aurora shooting

- Jeffrey Swanson: Looking inside the killer's mind will not turn up the answer

- He says most violence is not caused by a major psychiatric condition

- Swanson: True "reasons" that motivated killer's terrible act may be unknowable

Editor's note: Jeffrey Swanson is a professor in psychiatry and behavioral sciences at Duke University's School of Medicine.

(CNN) -- A witness to the horrific shooting rampage in the Colorado movie theater called it "the longest minute" of his life. One can only imagine. But the second longest minute may be the waiting for someone -- the authorities, the pundits, the doctors -- to tell us "why" these killings happened. Police say James Holmes, a 24-year-old graduate student in a neurosciences program, called himself the Joker and rained merciless bullets on strangers watching a Batman movie. Why?

Already, the speculations are flooding in. There's a celebrity psychiatrist saying it was a "failure of empathy" likely rooted in the shooter's early life psychological pain. What about asking the accused shooter's parents? "Listen, these folks that are now flying to join their son in Colorado, if you were to ask them, 'What three things are you most sensitive about not telling people, about your family or your son's personal development, or the things that are most painful to relate' -- there's your answer."

Jeffrey Swanson

Another psychiatrist thinks that people who commit crimes like this are "unfailingly unable to form satisfying sexual attachments, and their masculinity essentially gets replaced with their fascination for destruction."

Big Religion has also weighed in. "The product of pure evil ... a depraved individual taking his free will to the extreme," says the president of Focus on the Family. The head of the Southern Baptists commented that the incident "tells the truth about unbridled human sin."

They should all shut up. Let the police work. Let a competent clinician conduct a private evaluation. Let the professional reporters find out what really happened.

On the face of it, a deliberate rampage to kill strangers is the act of a deviant consciousness of some kind. But we don't know whether the accused killer's mind may have been driven by acute symptoms of a psychiatric disorder that impairs thought and perception of reality, by a personality misshaped through a troubled past, or by something else entirely. We simply don't know.

What we do know, based on the best available scientific evidence on the link between violence and mental illness in populations, is that most violence is not caused by a major psychiatric condition like schizophrenia, bipolar disorder or depression. Psychiatric disorder accounts for only about 4% of violent behavior, across the spectrum from minor to serious assaultive acts. And the vast majority of people with serious mental illnesses do not behave violently.

If research on patterns of violence in populations tells us anything, it's that no single thing causes assaultive behavior. Even when serious psychopathology plays a role, it is almost never a sufficient explanation. Other variables -- personal background characteristics and life experience, features of the social environment, substance abuse -- all may interact to make violent acts statistically more likely. That makes it complicated to explain and very difficult to predict actions on an individual level.

After the fact, rare and appalling acts of violence somehow look predictable, and thus, preventable. It is natural to turn to the experts, but they always come up short. They are notoriously bad at forecasting even garden variety violence, to say nothing of finding the one-in-a-million would-be mass shooter.

When we total up the contributions of all the risk factors with known links to violent behavior, most of it is left unexplained. When we describe the common characteristics of mass shooters, we're left with a profile that fits tens of thousands of troubled young men who would never actually do such a senseless thing.

"When we describe the common characteristics of mass shooters, we're left with a profile that fits tens of thousands of troubled young men who would never actually do such a senseless thing."

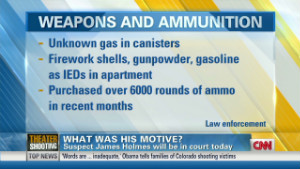

Is Holmes a psychopath? The true "reasons" that motivated the terrible act of which he is accused may always remain obscure. But what should not be obscure is how easy it is for troubled young men legally to acquire a small arsenal of firearms in the United States. If Holmes hadn't been able to get his hands on the guns police say he used, this would be a different story .

People can disagree about whether 270 million firearms in private hands in the country is too many guns. But they should not disagree that 300,000 people dying from gunshots in the past decade is too many wasted lives. The notion of forbidding assault weapons and large-capacity ammunition magazines -- machines specifically designed to kill multiple people in the twinkling of an eye -- is not about infringing the Second Amendment. It is about common sense and protecting the public. Such weapons were successfully legally banned in the United States from 1994 to 2004; they should be banned again.

Still, dangerous guns per se are not the only problem, and banning them is only part of the solution. We also need better means of identifying dangerous people who should not have access to guns.

Research shows that one of the highest risk times for violence in people who develop a psychotic illness is their first episode -- the period right before they establish any record with the formal mental health care system. Gun laws such as the federal Brady Act that are implemented through background record searches won't find these individuals. But even having a formal record of involuntary psychiatric hospitalization is no guarantee that the relevant information will be available at the point of purchase of a firearm.

In Colorado, only a tiny fraction (about 1%) of people who have gun-disqualifying mental health histories have been reported to the National Instant Check System, where they could be discovered in a routine background check of a prospective gun purchaser. A felony conviction is also supposed to disqualify people from buying a gun, but only 40% of murder suspects have such a previous record of conviction.

The present national moment of grief and soul searching should not become another occasion for oversimplifying the problem of gun violence and laying the blame on any one thing -- "it's the guns" or "it's untreated mental illness" or "it's the information system" or "it's the violent popular culture in society." It may be all of those things. We need to address all of the variables and come up with smart evidence-based policies. Looking inside the killer's head should not be the first place to start.

Follow us on Twitter @CNNOpinion

Join us on Facebook/CNNOpinion

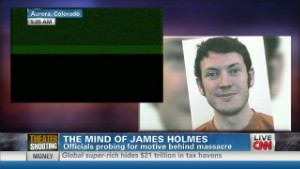

The public gets its first glimpse of James Holmes, 24, the suspect in the Colorado theater shooting during his initial court appearance Monday, July 23. With his hair dyed reddish-orange, Holmes, here with public defender Tamara Brady, showed little emotion. He is accused of opening fire in a movie theater Friday, July 20, in Aurora, Colorado, killing 12 people and wounding 58 others.

The public gets its first glimpse of James Holmes, 24, the suspect in the Colorado theater shooting during his initial court appearance Monday, July 23. With his hair dyed reddish-orange, Holmes, here with public defender Tamara Brady, showed little emotion. He is accused of opening fire in a movie theater Friday, July 20, in Aurora, Colorado, killing 12 people and wounding 58 others.